Scotland’s insolvency hotspots

May not be suitable in all circumstances. Fees apply. Your credit rating may be affected.

Free debt counselling, debt adjusting and providing of credit information services is available to customers by contacting MoneyHelper.

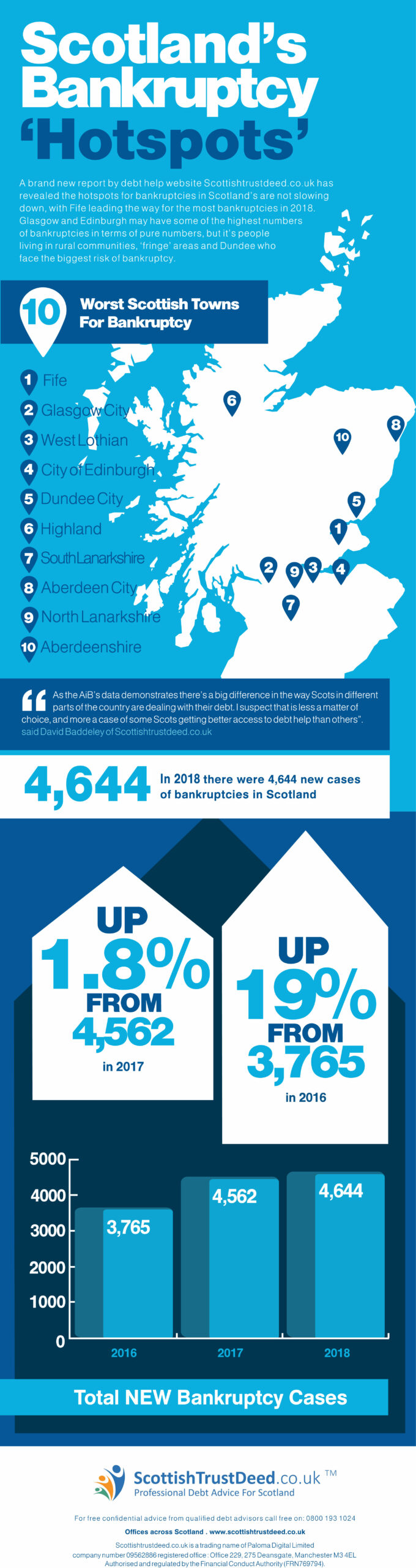

Glasgow and Edinburgh have some of the highest numbers of insolvencies, but it’s people living in rural communities who face the biggest risk of bankruptcy.

The AiB’s latest report shows a total of 4,644 people were declared bankrupt in 2017/18. That’s an increase of 1.8% year on year. 73% of bankruptcy applications in Scotland were made by an individual, the remainder were applications by creditors and four were trust deed petitions.

Sandwiched between Edinburgh, Dundee, Stirling and Perth, virtually everyone in the Fife region are within an hour’s drive of an urban area. According to the Fife Economy Partnership’s latest data, the employment rate is considerably better than the UK average. So why does Fife have such a high level of insolvency?

Earlier this year, Scottish Business Minister Jamie Hepburn told The Scotsman, “The ongoing uncertainty around Brexit, alongside the challenges of the roll out of Universal Credit, bear much of the blame.”

In 2011, The Herald reported that Kirkcaldy, Dunfermline and Glenrothes held three of the four top spots as the most insolvent towns in Britain. Perhaps even more alarmingly, the actual insolvency rates had improved considerably from the year before, when Glenrothes rate was 29% higher.

Bankruptcy is sometimes the only realistic option for Scots struggling with debt. But there are alternatives.

David Baddeley from Scottishtrustdeed.co.uk said:

“Bankruptcy can feel like the nuclear option and alternatives such as a protected trust deed can help individuals out of debt with fewer restrictions – and often with far less stigma – than sequestration.”

The AiB report shows the number of protected trust deeds was significantly higher than bankruptcies last year, but there are clear regional differences. Dundee had the highest proportion of bankruptcies but was only 16th for trust deeds, suggesting far less awareness of the potential of a trust deed here than in Glasgow for example.